Resources

What Is IFTA and Why It Matters

The International Fuel Tax Agreement (IFTA) governs how fuel taxes are distributed across states based on miles driven. Most fuel apps ignore IFTA entirely, leaving drivers and fleets unaware of how taxes affect real fuel cost.

Fuel Cost Education

Understand how fuel pricing really works beyond the pump.

Learn how fuel taxes vary by state, how they affect your total cost, and why the cheapest pump price is often not the cheapest option over a full route.

IFTA Basics & Insights

Clear explanations of IFTA without accounting jargon. Explore how the International Fuel Tax Agreement impacts fuel cost, refunds, and compliance—and why ignoring it leads to hidden expenses for both drivers and fleets.

Route Optimization Guides

Resources focused on route-based fueling strategies, showing how planning fuel stops holistically reduces total trip cost instead of optimizing one stop at a time.

Product Updates & Release Notes

Track new features, improvements, and changes to fuel logic, data sources, and optimization models—all explained clearly and transparently.

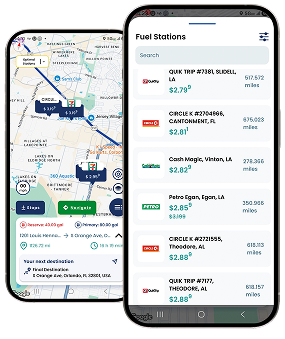

Route-Based Fuel Optimization

Fuel decisions should not be made in isolation. ZeroIFTA evaluates fuel options across the entire route, not just the next stop.

By analyzing prices, distance, and tax impact, the system selects fuel stops that minimize total trip cost, not just individual fill-ups.

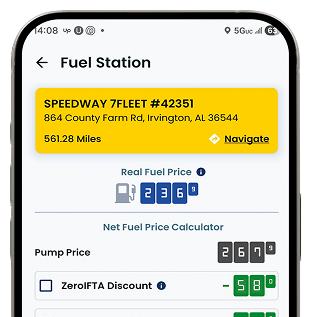

ZeroIFTA Changes the Calculation

ZeroIFTA goes beyond pump prices. It calculates the real fuel price, combining the retail price with applicable fuel taxes, and evaluates each fuel stop in the context of the entire route.

Instead of guessing, drivers and fleets get clear guidance based on actual cost.

Calculates real fuel price (pump price + fuel taxes)

Adapts to driver and fleet fueling preferences

Optimizes fuel stops based on total trip cost

Built specifically for long-haul trucking and IFTA realities

Smarter Fueling Through Route Planning

Fuel decisions should never be made one stop at a time. This section focuses on route-based fueling logic, showing how distance, fuel volume, and tax exposure interact across state lines.

By understanding how small differences compound over an entire trip, drivers and fleets can adopt fueling strategies that reduce total cost without disrupting normal operations or adding complexity.