About ZeroIFTA

Get money back when you file your IFTA instead of pay and save thousands of dollars every year.

Can You Save Money With IFTA?

Yes, you can if you follow the fallowing rule:

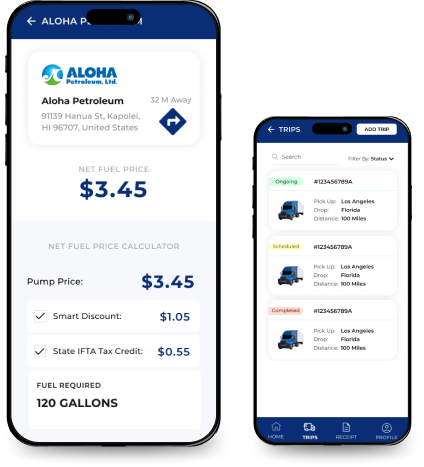

At ZeroIFTA, we’re revolutionizing how truckers and fleets manage fuel purchases to maximize savings and optimize IFTA tax rebates. Our mission is simple: help you keep more of your hard-earned money by guiding you to the most efficient fuel stops along your route.

By using ZeroIFTA, you can take advantage of fuel tax credits. For example, you can purchase fuel in a higher tax state and then consume it in a lower tax state. When you buy fuel in the higher tax region, you’re essentially depositing more money into your IFTA account, accumulating credit. As you drive through lower-tax states and consume that fuel, the credit covers the fuel taxes in those regions, and the remaining difference goes straight to your pocket when you file your quarterly IFTA report.

ZeroIFTA doesn’t just help with fuel taxes—it also tells you when it’s more cost-effective to pay the IFTA taxes and take advantage of lower fuel prices at the pump, ensuring you always make the most profitable decision. Our app calculates the optimal fuel stops and how many gallons to buy to give you the most efficient price along your route, allowing you to focus on the road and your work.

With ZeroIFTA, you no longer need to spend time crunching numbers—we handle the calculations for you. From maximizing savings on fuel to streamlining your IFTA reporting, ZeroIFTA is designed to help you save time and money, mile after mile.

To know more about how IFTA works you can check the following YouTube videos.