International Fuel Tax Agreement

IFTA allows commercial motor carriers to register in one state.

What is the International Fuel Tax Agreement (IFTA)?

The International Fuel Tax Agreement (IFTA) is an arrangement among U.S. states and Canadian provinces. Taxes are paid on motor fuels, and IFTA allows commercial motor carriers to register in one state and have these tax assessments paid out to all participating areas according to their fair share.

HOW ARE FUEL TAXES ASSESSED?

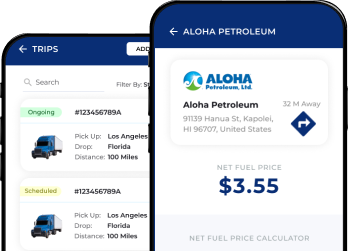

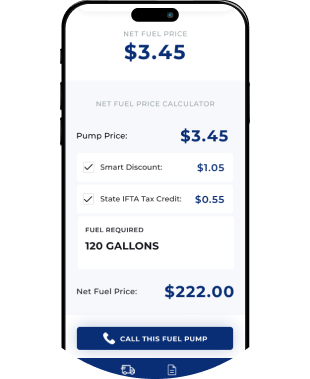

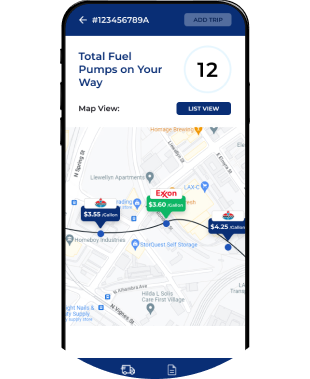

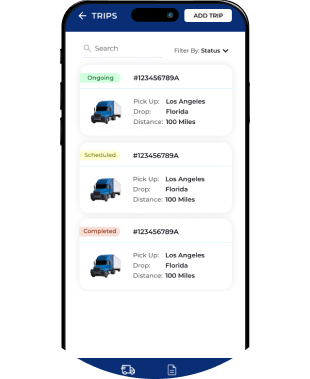

Fuel taxes are assessed in each state or province and are paid at the pump as they are included in the pump price, with each jurisdiction having its own tax rate. Commercial trucking operations with an IFTA permit report quarterly on the fuel consumed in each jurisdiction, and taxes are calculated proportionally. The amount of tax paid at the pump is credited against the amount owed, resulting in a payment or refund for the difference. The ZeroIFTA app considers all these factors to optimize the pre-tax price you pay for your fuel.

HOW IFTA WORKS?

Under this program, a truck is IFTA registered and obtains a fuel tax permit from one state. When the vehicle drives through any participating state or province, the tax on fuel purchased there is credited to the permit owner’s account. At the end of the quarter a fuel tax report is completed that shows miles traveled and gallons of fuel for each region.

IFTA assists in calculating the amount of tax due or tax credit for each state, to determine the tax liability for each and to oversee the distribution of funds accordingly.

IFTA QUALIFICATIONS

Commercial motor vehicles are IFTA qualified. Specifically, these are commercial vehicles with three or more axles, or with two axles and a gross weight exceeding 26,000 pounds, used to transport goods or passengers.

For IFTA qualification, these vehicles are operated in at least two states of the U.S. and/or Canadian provinces which are members of the International Fuel Tax Agreement.

All 10 provinces of Canada are members of the agreement, as are all 48 contiguous states of the USA. Alaska and Hawaii are not members.

Private or recreational vehicles for personal use are not subject to IFTA licensing.

FILING REPORTS WITH IFTA

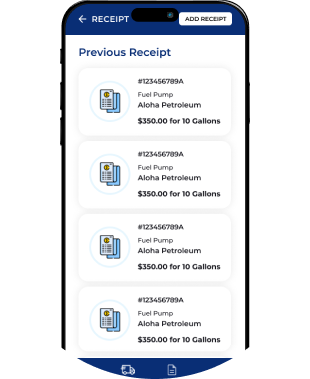

For filing IFTA claims, at the end of the fiscal quarter the licensee produces a fuel tax report listing miles traveled in all participating jurisdictions and gallons of fuel purchased there. Supporting documents include the vehicle mileage record, distance records, fuel records and tax-paid retail fuel purchase receipts. All relevant data such as gap miles and fuel receipts must be included when reporting IFTA claims.